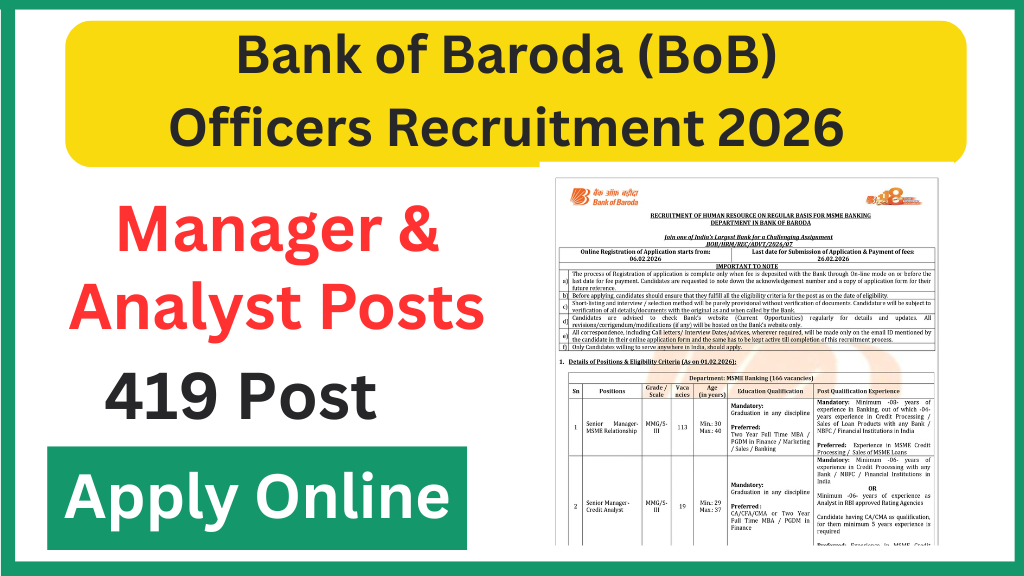

Bank of Baroda (BoB) Officers Recruitment 2026: The Bank of Baroda has released a major recruitment notification for the year 2026, targeting experienced banking professionals for various officer-level positions. This is a golden opportunity for those looking to build a career in one of India’s premier public sector banks. The recruitment is being conducted for the MSME Banking Department across both Regular (Permanent) and Contractual bases.

With a total of 419 vacancies available for roles like Senior Manager, Credit Analyst, and Assistant Vice President, this recruitment drive is set to attract top talent from the banking sector.

BoB Officers Recruitment 2026: Overview

The Bank of Baroda is looking to strengthen its MSME (Micro, Small, and Medium Enterprises) wing by hiring skilled specialists. The recruitment is divided into two distinct notifications: one for permanent roles and another for fixed-term contractual positions (5 years).

| Recruitment Body | Bank of Baroda (BoB) |

| Total Vacancies | 419 |

| Post Types | Regular (166) & Contractual (253) |

| Notification Date | February 6, 2026 |

| Application Start | February 6, 2026 |

| Last Date to Apply | February 26, 2026 |

| Selection Basis | Online Test / Interview / Psychometric Test |

| Official Website | bankofbaroda.in |

Important Dates to Remember

- Official Notification Release: February 6, 2026

- Start of Online Applications: February 6, 2026

- Last Date to Apply & Pay Fees: February 26, 2026

- Exam Date: To be notified later

Detailed Vacancy Breakdown

Candidates should carefully note the distribution of seats between Regular and Contractual categories before applying.

1. Regular Positions (Permanent – 166 Posts)

These are permanent government banking jobs under the Middle Management Grade (MMG) scales.

- Senior Manager – MSME Relationship (MMG/S-III): 113 Posts

- Senior Manager – Credit Analyst (MMG/S-III): 19 Posts

- Manager – Credit Analyst (MMG/S-II): 34 Posts

2. Contractual Positions (5-Year Term – 253 Posts)

These roles are on a fixed-term basis, offering market-linked competitive salaries.

- Assistant Vice President – MSME Relationship: 14 Posts

- Deputy Manager – MSME Relationship: 62 Posts

- Assistant Manager – MSME Sales: 177 Posts

Eligibility Criteria (As of 01.02.2026)

To apply for these prestigious officer roles, candidates must meet specific educational and experience requirements.

Educational Qualification

- Relationship & Sales Roles: A Graduation degree in any discipline from a recognized University.

- Credit Analyst Roles: A Graduation degree in any discipline. Professional qualifications like CA, ICWA, or MBA (Finance) are often preferred for these roles.

Mandatory Work Experience

Since these are specialist officer roles, experience is non-negotiable:

- Assistant Manager (Sales): Min. 2 years in Asset Sales.

- Manager (Credit Analyst): Min. 3 years in Credit Processing/Analyst roles.

- Deputy Manager (Relationship): Min. 3 years in Asset Sales.

- Sr. Manager (Relationship): Min. 8 years in Banking (with 4 years in Credit/Sales).

- Sr. Manager (Credit Analyst): Min. 6 years in Credit Processing.

- Assistant Vice President: Min. 5 years in Asset Sales.

Age Limit

| Post | Age Range |

| Assistant Manager | 22 – 32 Years |

| Deputy Manager | 24 – 34 Years |

| Manager | 25 – 34 Years |

| Assistant Vice President | 26 – 36 Years |

| Sr. Manager (Credit) | 28 – 37 Years |

| Sr. Manager (Relationship) | 30 – 40 Years |

Age relaxation is applicable as per government norms: 5 years for SC/ST, 3 years for OBC, and 10 years for PwD candidates.

Salary and Compensation Package

Bank of Baroda offers some of the most competitive pay structures in the Indian banking industry.

- Regular Posts: Officers will receive Basic Pay (Scale II approx. ₹64,820; Scale III approx. ₹85,920) plus DA, HRA, Special Allowance, Medical benefits, and Lease Rental.

- Contractual Posts: Remuneration is market-linked. It is negotiable based on the candidate’s current CTC, experience, and the location of the posting.

Note on Credit Score: Candidates must have a healthy credit history. A minimum CIBIL score of 680 is required at the time of joining.

Selection Process

The selection will be conducted through a three-phase approach to ensure only high-caliber professionals are onboarded.

- Online Test: Required if the number of applicants is high. It covers Reasoning, English, Quant, and Professional Knowledge (Total 225 Marks).

- Psychometric Test: To evaluate the candidate’s psychological fit for the leadership role.

- Personal Interview: The final deciding factor. Candidates must score at least 60% (General/EWS) or 55% (Reserved) in the interview to be considered.

Application Fee Details

| Category | Fee Amount |

| General / OBC / EWS | ₹ 850/- + Charges |

| SC / ST / PwD / Women | ₹ 175/- + Charges |

How to Apply Online: Step-by-Step Guide

Ready to apply? Follow these steps to ensure a smooth registration process:

- Preparation: Scan your photo, signature, detailed Resume (PDF), and experience certificates.

- Visit Portal: Go to the “Careers” section on bankofbaroda.in.

- Registration: Click on the specific link for “Regular” or “Contractual” posts. Fill in your basic details to get your Registration ID and Password.

- Application Form: Log in and fill in all educational and experience details accurately.

- Document Upload: Upload your Resume and other documents (ensure they are under 500kb).

- Payment: Use the online gateway to pay the fees via UPI, Credit Card, or Net Banking.

- Final Print: Download the e-receipt and the final submitted application form for your records.

Important Links

| Apply Online (Regular Posts) | Click Here |

| Apply Online (Contractual Posts) | Click Here |

| See Official Notification (Regular Posts) | Click Here |

| See Official Notification (Contractual Posts) | Click Here |

| Official Website | Click Here |

| Join WhatsApp Channel | Click Here |